May 20, 2025

Politics & Power

Featured

Senate Crypto Bill Advances: What the Genius Stablecoin Act Means for the Future of Crypto and the Bigger Economic Picture

In recent developments, the U.S. Senate has taken a significant step forward by voting to advance the Genius Stablecoin Act. While it’s important to clarify that the bill itself has not yet passed, this progress marks a pivotal moment in the regulatory landscape for cryptocurrency. As someone deeply invested in the crypto space, I want to break down what this senate crypto bill means for the industry, explore the broader macroeconomic factors at play, and analyze the current state of key cryptocurrencies like Bitcoin, Ethereum, and Cardano. This comprehensive look will help you understand why this moment is so crucial for crypto investors and enthusiasts alike.

Table of Contents

- Understanding the Genius Stablecoin Act and Its Current Status

- The Bigger Picture: Macroeconomic Forces and an Economic Boom

- Why the Altcoin Bull Market Is Still Ahead

- Deep Dive Into Ethereum’s Current Technical Setup

- Cardano (ADA): Testing Critical Resistance and Potential for Massive Gains

- Managing Expectations and Portfolio Strategy in This Cycle

- Conclusion: Why the Senate Crypto Bill Is Just the Beginning

- Frequently Asked Questions (FAQ)

- Related Articles

- Related Insights on Economic and Policy Developments

Understanding the Genius Stablecoin Act and Its Current Status

First things first: the Senate has voted to move forward with the Genius Stablecoin Act by passing the motion to invoke cloture. This procedural step means the bill will now proceed to the debate and amendment process on the Senate floor. However, the bill itself has not been passed yet, so it’s not law—yet. But this is a massive step in the right direction for crypto regulation.

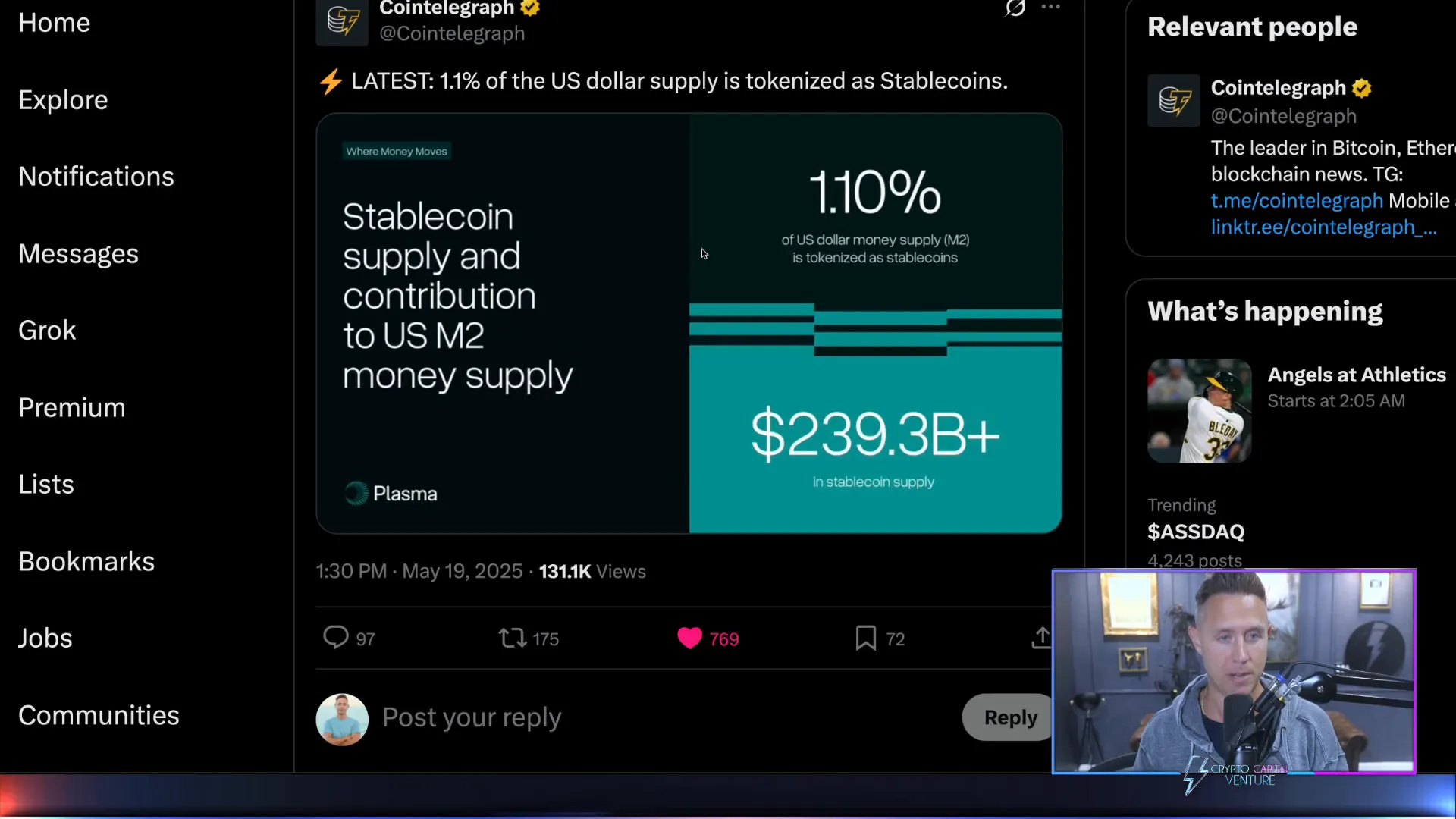

Why does this matter? Stablecoins currently represent only about 1.1% of the total U.S. dollar supply, which is a relatively small but rapidly growing portion of the overall financial system. If passed, the Genius Act could unlock a tremendous amount of liquidity for the crypto market. This isn’t just about adding a few billion dollars; it’s about opening the floodgates for capital inflows that could redefine how crypto markets operate.

To put this into perspective, stablecoins serve as a bridge between traditional fiat currency and crypto assets, facilitating faster and cheaper transactions. By providing regulatory clarity and a framework for stablecoins, the Genius Act could encourage institutional investors and everyday users alike to participate more confidently in the crypto ecosystem. This aligns with my long-term thesis: trillions of dollars are incoming into crypto, catalyzed by regulatory clarity and a pro-crypto administration.

The Bigger Picture: Macroeconomic Forces and an Economic Boom

While the Genius Stablecoin Act is crucial, it’s part of a larger economic narrative unfolding right now. The macroeconomic landscape is shifting, and it’s vital to consider these broader forces when evaluating crypto’s future.

Recently, the stock market experienced a capitulation event marked by record-breaking levels of fear and uncertainty. Interestingly, Bitcoin weathered this storm better than many expected, holding up strongly during this high-fear environment.

Beyond crypto, there’s a new tax bill under consideration that promises significant economic growth. According to a detailed analysis from the Council of Economic Advisors (CEA), this bill could raise U.S. GDP by 4.2% to 5.2%, create seven million new jobs, and increase take-home pay for a typical family of four by $8,000 to $13,000. This kind of economic boom would translate into more disposable income, higher consumer spending, and ultimately, increased tax revenue.

Though this tax bill is separate from the stablecoin legislation, it creates a favorable environment for crypto adoption. Stronger economic growth means more capital available for investment, including in digital assets. This positive macroeconomic backdrop supports the thesis that we’re on the cusp of a major bull run—not just for Bitcoin, but especially for altcoins.

Why the Altcoin Bull Market Is Still Ahead

One of the most important points I want to emphasize is that, despite Bitcoin’s impressive price action and breakout from long-term macro structures, altcoins have yet to begin their true bull market. Historically, altcoins tend to lag behind Bitcoin during the early stages of a crypto cycle, and this time is no different.

The total crypto market cap excluding Bitcoin is still consolidating after multiple years. Unlike Bitcoin’s clear inverse head and shoulders pattern signaling a breakout, altcoins have not yet formed a similar structure. This means the altcoin market is primed for a breakout that could surpass anything we’ve seen before.

When altcoins finally break out, I expect Bitcoin dominance—the percentage of the total crypto market cap that Bitcoin holds—to fall significantly as investors diversify into lower-cap coins. This shift could ignite a spectacular altcoin bull run, potentially driven by the liquidity unlocked through stablecoin regulation and the broader economic upswing.

Deep Dive Into Ethereum’s Current Technical Setup

Ethereum remains one of the most critical cryptos to watch as it often leads or confirms market trends. Recently, Ethereum experienced a pullback after testing a crucial resistance area known as the Apex, failing at the 50-week moving average and the lower trend line.

Currently, Ethereum is positioned just below this lower trend line but above the 200-week and 20-week moving averages. To clear this resistance and signal a macro reversal into a bull market, Ethereum needs to make a 5-6% move to break the lower trend line and possibly an 8-8.5% move to retest the 50-week moving average near $2,700.

This resistance zone is a significant multi-year hurdle. If Ethereum can break through, it could trigger a rapid surge in altcoins since many smaller tokens closely follow Ethereum’s momentum. Conversely, failure to break above may lead to further consolidation or a retest of support levels.

Cardano (ADA): Testing Critical Resistance and Potential for Massive Gains

Cardano is another altcoin showing promising signs of a potential breakout. Like Ethereum, ADA is testing a key resistance level at the 20-week moving average on its weekly chart.

Looking back at previous cycles, ADA’s break above the 20-week moving average was a massive catalyst—resulting in nearly 3,000% gains. Currently, ADA is in a similar position, testing this crucial level again. It’s worth noting that ADA is still near the bottom of its bull market range, supported by the 200-week moving average around 70 cents.

If ADA breaks above this resistance, we could see an explosive rally, potentially reaching $7 or higher. While past performance is no guarantee, the structural similarities in the charts are compelling. This could coincide with the broader altcoin bull market, which I firmly believe is on the horizon.

Managing Expectations and Portfolio Strategy in This Cycle

It’s important to remember that crypto cycles are evolving. The straightforward four-year cycles many investors relied on in the past are now more complex. Patience is being tested, but this doesn’t negate the underlying macro thesis: higher highs, higher lows, and trillions of dollars flowing into crypto assets in the coming years.

My approach is to stay informed, understand the possibilities, and position my portfolio accordingly for the long term. This means being ready for volatility, recognizing key breakout points, and preparing for a potential altcoin bull run. Tools like risk models and strategic exit planning are essential to navigate what could be one of the most exciting phases in crypto history.

Conclusion: Why the Senate Crypto Bill Is Just the Beginning

The senate crypto bill, specifically the Genius Stablecoin Act, represents a monumental step toward legitimizing and expanding crypto markets. Coupled with a promising macroeconomic outlook and technical signals from major cryptocurrencies, the stage is set for a transformative period in crypto investing.

While the bill itself has yet to become law, the momentum behind it and the broader economic factors at play suggest that significant liquidity and capital inflows are imminent. Altcoins, in particular, appear poised for an unprecedented bull market, driven by regulatory clarity, economic growth, and favorable technical setups.

Stay tuned, stay informed, and prepare your portfolio wisely. The future of crypto is unfolding right now, and it’s bigger than just one bill—it’s about a new era of innovation and opportunity.

Frequently Asked Questions (FAQ)

What is the Genius Stablecoin Act?

The Genius Stablecoin Act is proposed legislation aimed at providing regulatory clarity and a legal framework for stablecoins in the U.S. It is designed to foster innovation while ensuring consumer protection and financial stability.

Has the Senate passed the Genius Stablecoin Act?

As of now, the Senate has voted to advance the bill by invoking cloture, which means it will proceed to debate and potential amendments. The bill itself has not yet been passed into law.

Why are stablecoins important for crypto?

Stablecoins act as a bridge between fiat currency and cryptocurrencies, providing liquidity and stability. They enable faster and cheaper transactions and are essential for decentralized finance (DeFi) and trading activities.

How does the Genius Act affect crypto liquidity?

If passed, the Act could unlock a massive influx of capital into the crypto market by legitimizing stablecoins, which currently represent just 1.1% of the U.S. dollar supply. This increased liquidity can drive broader adoption and price appreciation.

What is the current state of the altcoin market?

Altcoins are still consolidating and have yet to begin their major bull market. Technical analysis suggests they are poised for a breakout, which could lead to substantial gains as Bitcoin dominance potentially decreases.

How should investors prepare for the upcoming crypto cycle?

Investors should stay informed about regulatory changes, monitor key technical levels in cryptocurrencies like Ethereum and Cardano, and use risk management tools to position their portfolios for potential volatility and growth.

Related Articles

- Explore the Latest in Science & Tech

- Business & Economy Insights

- Opinion & Analysis on Market Trends

- Politics & Power: How Policy Shapes Markets

Related Insights on Economic and Policy Developments

Understanding the broader economic and political environment can provide valuable context for the future of cryptocurrency and stablecoin legislation. For instance, explore the factors influencing the Reserve Bank of Australia's potential rate cut, its impact on the property market, borrowing capacity, and what to watch for in fixed rates. Such monetary policy decisions can have ripple effects on global markets, including crypto.

Moreover, political dynamics can shape regulatory approaches. The recent Nationals' decision to end their coalition with the Liberals highlights shifts in policy priorities that may indirectly affect economic conditions and investment climates. Staying informed about these developments helps investors anticipate changes that could impact crypto markets.

For those interested in how policy influences markets more broadly, Peter Dutton's surprising backflip on working from home offers insights into leadership decisions and their wider implications, reflecting the complex interplay between politics and economics.

By keeping an eye on these and other related economic and political stories, crypto investors can better position themselves to navigate the evolving landscape shaped by legislation like the Genius Stablecoin Act.