Robo-debt Victims Win Historic Payout in Australia’s Biggest Class Action

In a report from 7NEWS Australia, hundreds of thousands of Australians impacted by the federal government's Robo‑debt scheme have won a historic class action settlement. The decision brings a rare moment of vindication for victims who say the automated debt‑recovery program left them financially and psychologically devastated.

Table of Contents

- Introduction: a human toll and a legal milestone

- What was Robo‑debt?

- The settlement: how much and who benefits?

- Accountability: criticisms, but limited consequences

- The human cost: lives disrupted and sometimes destroyed

- Why the payout matters — and why it won't fix everything

- Conclusion

- FAQ

Introduction: a human toll and a legal milestone

Felicity Button, one of the many people targeted by Robo‑debt, described the torment the scheme inflicted on her life. In her own words she recalled a moment when, driving down the freeway with her baby daughter, she thought of running into a tree because "that would solve all my problems." As she added bluntly: "It doesn't."

"She was in the car with me as I was driving down the freeway thinking of running into a tree because that would solve all my problems. It doesn't."

Today, for the first time in a long time for many victims, a sense of fairness has arrived. The class action is settled: the Albanese government has added almost $550 million in compensation to the $112 million previously agreed by the Morrison government — a package that, together with prior repayments, brings the total cost of Robo‑debt to roughly $2.4 billion.

What was Robo‑debt?

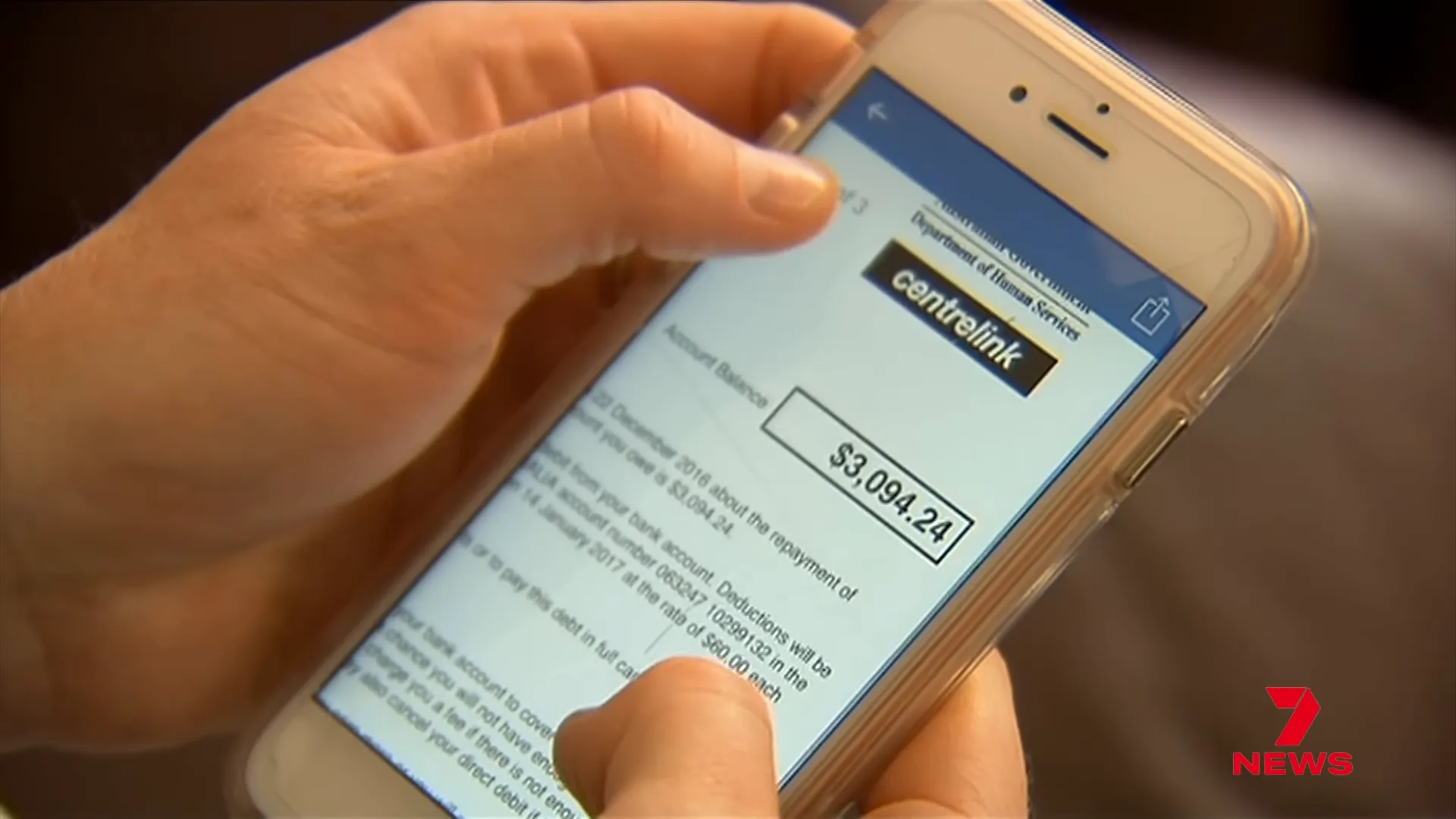

The Robo‑debt scheme was an automated approach used by the government agency to detect and recover alleged welfare overpayments. An algorithmic process compared annual tax records with fortnightly welfare payments and generated debt notices by averaging income over time, often without checking individual circumstances. The result was a large number of incorrect debt notices issued to welfare recipients.

Those notices forced many recipients into fight-or-pay decisions, sparking financial ruin, emotional distress and, in some tragic cases, worsening mental health outcomes.

The settlement: how much and who benefits?

The settlement announced is historic in scale and significance.

- Approximately 450,000 Robo‑debt victims will share the payout.

- The Albanese government added almost $550 million in compensation to the $112 million committed by the Morrison government — together roughly $660 million in compensation payments.

- That compensation sits alongside about $1.7 billion already repaid to people who were wrongly chased for debts.

- The combined cost to the federal budget and taxpayers is roughly $2.4 billion, making this the largest class action settlement in Australian history.

"Today is a day of vindication and validation for hundreds of thousands of Australians."

Accountability: criticisms, but limited consequences

While the Royal Commission into the scheme levelled heavy criticism at senior figures — including former Prime Minister Scott Morrison and ministers Alan Tudge and Stuart Robert — the legal and political consequences for those at the centre of designing and implementing Robo‑debt have been limited. Many victims and advocates argue that no one has been fully held to account for the policy choices and failures that produced such widespread harm.

"Nobody who is really responsible for Robodebt has been fully held to account."

The human cost: lives disrupted and sometimes destroyed

The settlement does not erase the personal consequences endured by many. The scheme's pressure placed immense strain on families and individuals: some lost family members, others experienced divorce, bankruptcy, or long-term mental health impacts.

"People that have lost family members, people that have gone through divorce, become bankrupt. The Robodebt scheme destroyed lives."

Why the payout matters — and why it won't fix everything

The compensation package is an important recognition that the program was deeply flawed, and it will deliver financial redress to hundreds of thousands of people. For many victims, the settlement provides validation after years of fighting to be heard.

But money alone cannot fully repair the emotional and social damage caused. Legal settlements and repayments are partial remedies; many advocates continue to press for stronger systemic safeguards to ensure that automated administrative systems do not repeat these mistakes.

"And for that money? ... is little compensation."

Conclusion

The Robo‑debt settlement marks a legal and moral milestone: a large-scale acknowledgement that government policy and automated processes can do serious harm when oversight, human review and fairness are sidelined. While the settlement offers recompense and a form of vindication, it also underscores the need for accountability, reform and better protections for people who rely on the social safety net.

FAQ

What is Robo‑debt?

Robo‑debt was an automated system used by the government to identify and recover alleged overpayments of welfare by comparing tax and Centrelink records, using income averaging to calculate supposed debts.

How much is the settlement worth?

The Albanese government added almost $550 million to $112 million previously agreed, producing roughly $660 million in compensation payments. Along with about $1.7 billion already repaid to people, the total cost is around $2.4 billion.

How many people will receive compensation?

About 450,000 people who were affected by Robo‑debt are expected to share in the compensation package.

Have those responsible been held to account?

Senior officials and ministers were heavily criticised by the Robodebt Royal Commission, but many critics say that full legal or political accountability for the architects and implementers of the scheme has been limited.

Does the settlement fix the harm done?

The settlement provides financial redress and public recognition of wrongdoing, but it cannot fully repair the psychological, social and long-term harms experienced by many victims. Advocates call for stronger safeguards to prevent similar failures in future.