Aug 3, 2025

Copper Concerns: How Import Tariffs Could Reshape Construction and Housing Costs

As the United States faces new tariffs on copper imports, the ripple effects are poised to impact the construction industry, housing market, and a broad range of sectors reliant on this essential metal. The recent announcement of a 50 percent tariff on copper imports by the Trump administration has raised alarms among builders, manufacturers, and supply chain experts who warn of significant cost increases ahead.

Table of Contents

- The Immediate Impact on Construction Costs

- Why Copper Tariffs Matter Beyond Housing

- Challenges to Increasing Domestic Copper Production

- Housing Market Struggles Amplified

- The Call for Stability in Trade Policy

- Conclusion: Navigating the Copper Tariff Landscape

- Frequently Asked Questions

The Immediate Impact on Construction Costs

Andrew Moore, a home builder nearing completion of a new house, recently encountered firsthand the challenges posed by rising copper prices. The house, almost ready for its owner, was finished just before the tariff hike took effect. The tariff means building materials containing copper—such as electrical panels, breakers, and wiring—will become substantially more expensive.

“We expect a 10 to 25 percent increase in all of these allowances that I'm putting into the contract,” Moore explained. Builders now face the difficult task of communicating these price uncertainties to homeowners. “This is what we know. This is what we think we can control. This is what we know and we think we can't control,” he said, highlighting the tension between predictable costs and market volatility.

Why Copper Tariffs Matter Beyond Housing

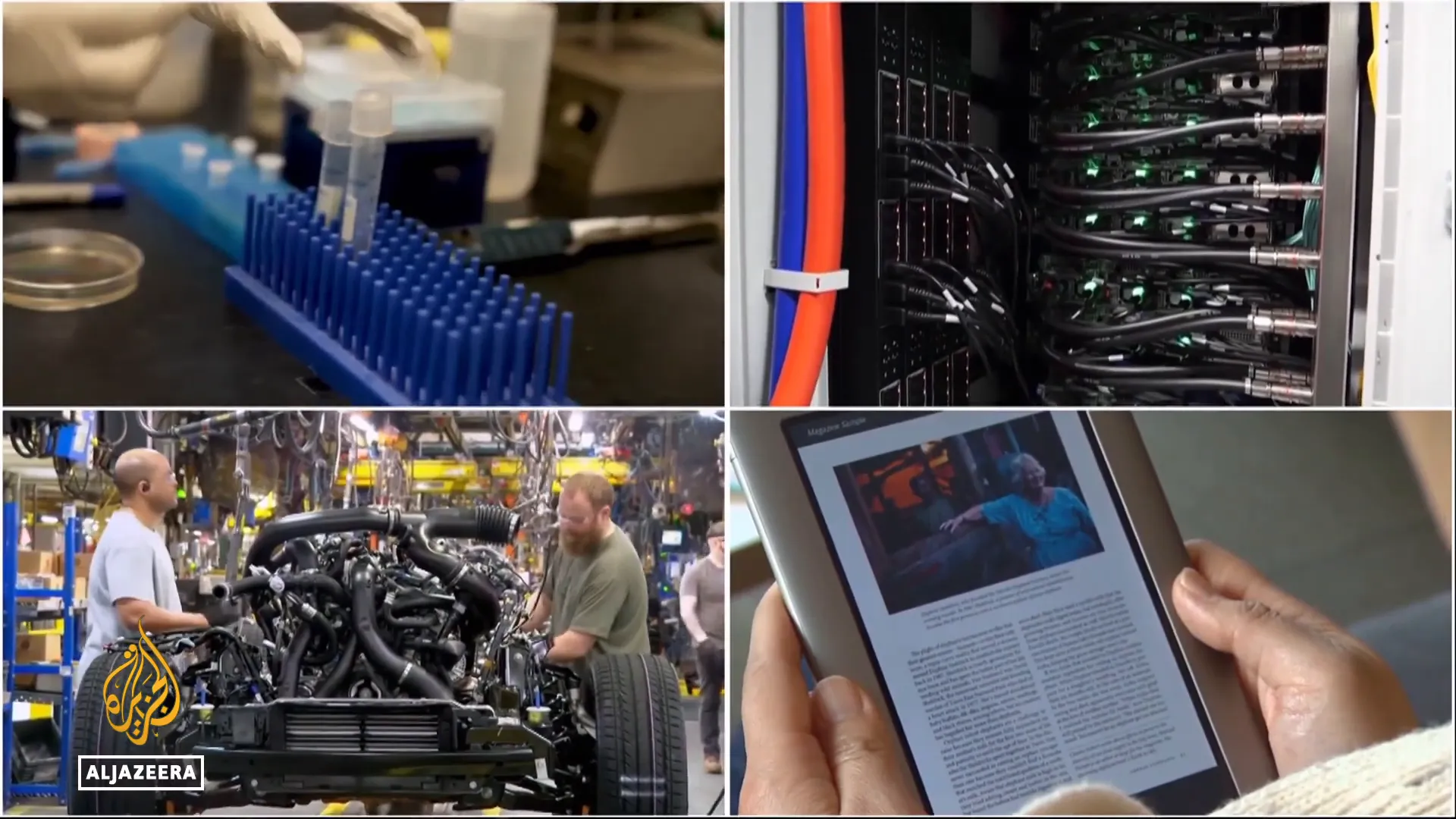

Copper is the third most used mineral in the American supply chain, essential not only for construction but also for manufacturing cars, electronics, energy infrastructure, and medical devices. Because of its widespread use, the tariff’s impact will extend far beyond just home building.

The United States currently imports about half of its copper supply. The administration’s goal is to encourage more domestic production to reduce reliance on foreign sources. However, increasing domestic mining capacity faces significant hurdles.

Challenges to Increasing Domestic Copper Production

Environmental regulations have made it difficult to approve new copper mines in the U.S., with permitting processes taking as long as 30 years. This regulatory burden means that even with tariffs aimed at boosting local production, supply constraints will persist in the near term.

“If you place tariffs on copper and don’t address regulatory burdens, you’re going to see higher prices caused by the tariffs,” the report noted. The result is a complex situation where tariffs push prices up, but domestic production can’t ramp up quickly enough to offset these increases.

Housing Market Struggles Amplified

The U.S. housing market is already under pressure from a shortage of available homes, slowed construction, and high interest rates. The increased cost of copper adds another layer of difficulty for builders and homebuyers alike.

“There's a lack of stock, building has slowed, interest rates are high, and now it becomes more expensive to build and buy,” the analysis explains. This tariff-induced cost increase threatens to further stall the market, just as the government aims to stimulate home building.

The Call for Stability in Trade Policy

Historically, tariffs have been introduced and then lifted, creating uncertainty for businesses. Industry experts emphasize that what’s most needed is pricing stability. Even if prices are higher, predictable costs would encourage builders and manufacturers to move forward with projects.

“If people could be certain about their pricing, even if it was higher pricing, they would be more willing to go forward,” the report stated. The ongoing threat of tariffs has already pushed copper prices upward, potentially serving as a negotiating tactic but causing real pain for many sectors.

Conclusion: Navigating the Copper Tariff Landscape

The imposition of a 50 percent tariff on copper imports aims to stimulate domestic production but faces significant challenges from regulatory delays and environmental concerns. Meanwhile, the immediate effect is an increase in construction and manufacturing costs across the U.S. economy. With housing already facing multiple headwinds, this tariff could exacerbate affordability issues and slow economic recovery in key sectors.

For homeowners, builders, and industries dependent on copper, the path forward depends heavily on trade policy stability and regulatory reforms that can balance economic growth with environmental stewardship.

Frequently Asked Questions

Why is copper so important to the U.S. economy?

Copper is the third most used mineral in the American supply chain and is essential for construction, automotive manufacturing, electronics, energy infrastructure, and medical devices. Its widespread use means changes in copper prices affect many industries.

How will the 50 percent tariff on copper imports affect home building?

The tariff will increase the cost of copper materials such as wiring, electrical panels, and breakers, leading to higher construction costs. Builders may pass these costs on to buyers, making homes more expensive.

Why can't the U.S. just produce more copper domestically?

New copper mines face lengthy permitting processes due to environmental regulations, often taking decades for approval. This delays the ability to increase domestic copper supply quickly enough to offset tariff impacts.

What is the housing market outlook with these tariffs?

The housing market is already challenged by limited supply, slowed building, and high interest rates. Increased copper costs add further strain, potentially making homes less affordable and slowing construction.

Will the tariffs stay in place permanently?

Tariffs have been introduced and lifted before, creating uncertainty. Many experts call for stable trade policies to allow businesses to plan and manage costs effectively, even if prices are higher.