Mar 3, 2025

Woolworths Returns to Profit Amid Rising Costs and Market Scrutiny

Woolworths, Australia's largest supermarket chain, has made headlines by returning to profitability after a significant loss the previous year. This rebound is seen as a response to various factors impacting both the company and its consumers. As the cost of living escalates, the implications of Woolworths' financial recovery extend beyond simple profit margins, raising questions about pricing strategies, competition, and consumer welfare.

Table of Contents

- Woolworths' Financial Turnaround

- Pricing Strategies and Consumer Impact

- Cost-Cutting Measures and Job Losses

- Regulatory Scrutiny and Legal Challenges

- Consumer Sentiment and Market Alternatives

- The Call for Grocery Price Relief

- FAQ

Woolworths' Financial Turnaround

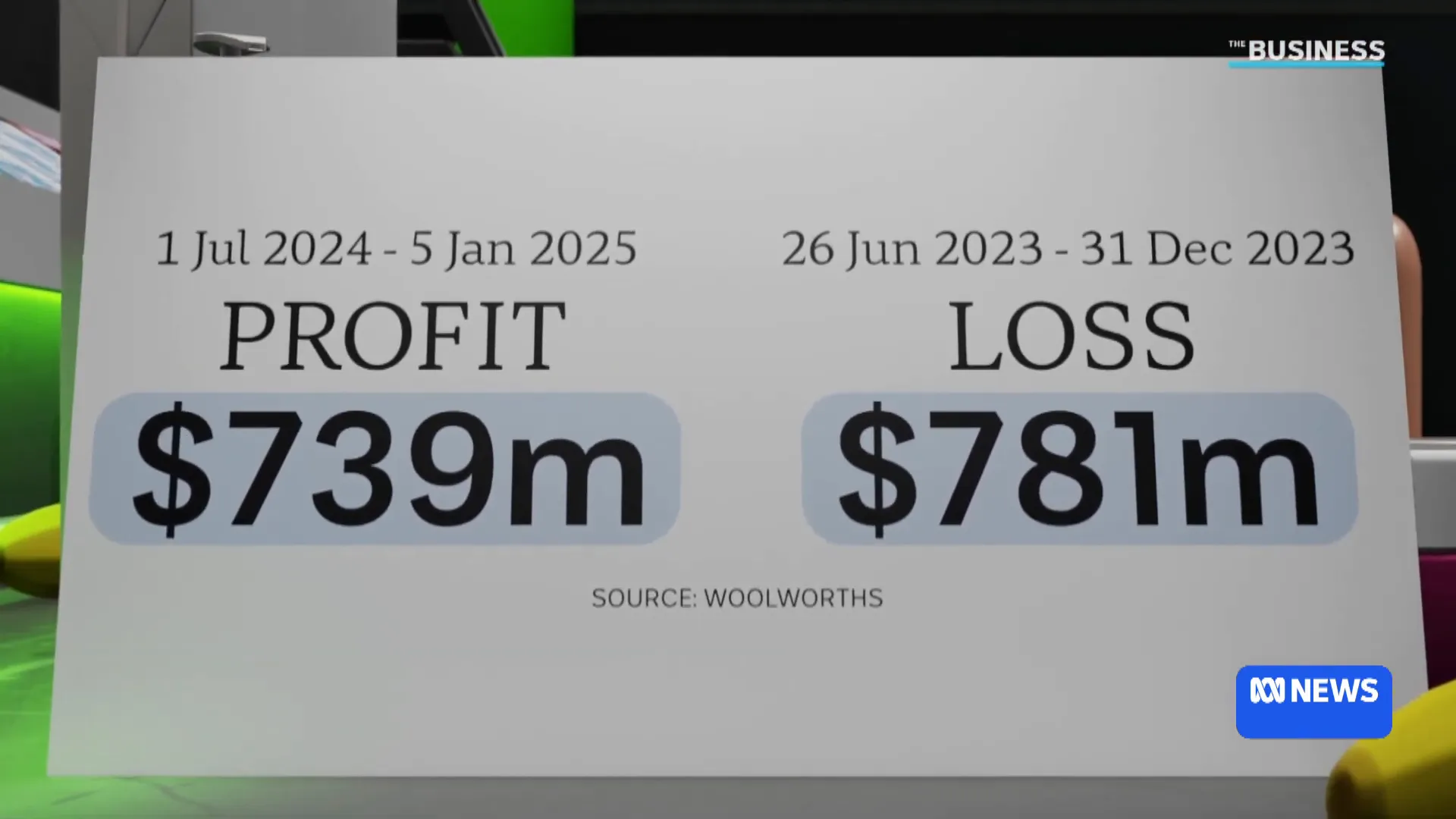

Woolworths reported a profit of $739 million for the six months ending January 5, a stark contrast to the $781 million loss it faced the previous year. This turnaround has not come without its challenges. The supermarket's gross food margin has taken a hit, dropping by 32 basis points due to several factors including increased meat costs, heightened discounts, and a shift in consumer purchasing habits towards cheaper items.

Strikes at its distribution centers also played a significant role, costing the business an estimated $240 million. These strikes highlight the ongoing tensions within the supply chain, which have contributed to the complexities of pricing in the supermarket sector.

Pricing Strategies and Consumer Impact

Woolworths' CEO has claimed that average selling prices have been lower than the previous year for four consecutive quarters. However, many consumers express skepticism about these claims. As one shopper noted, "fruit and vegetables are just getting more and more expensive." This sentiment reflects a broader concern that while Woolworths reports a profit, the realities of rising grocery prices are felt acutely by everyday Australians.

Critics argue that the supermarket's pricing strategies are indicative of aggressive oligopolistic practices. With both Woolworths and Coles dominating the market, accounting for approximately 67% of supermarket retail sales, there are growing concerns about how this concentration affects competition and pricing.

Cost-Cutting Measures and Job Losses

In a bid to maintain profitability, Woolworths has announced plans to cut $400 million in costs, which will inevitably result in job losses. The company has also decided to reduce the number of products it sells, a move that mirrors similar actions taken by Coles. This strategy seems aimed at streamlining operations and focusing on their home brand products, which can offer higher margins.

Retail analyst George Boubouras from K2 Asset Management suggests that both supermarkets will continue to expand their home brand ranges to sustain margins and satisfy shareholder demands. However, these changes raise questions about consumer choice and the potential impact on product variety.

Regulatory Scrutiny and Legal Challenges

The Australian Competition and Consumer Commission (ACCC) is currently investigating the market power of Woolworths and Coles. It has taken both companies to court over allegations of misleading pricing practices, claiming they inflated the prices of hundreds of grocery items before advertising them as discounted. This legal scrutiny underscores the tension between profitability and ethical consumer practices.

As food prices are identified as a significant contributor to inflation, with an increase of 3.3% in the year leading up to January, the ACCC's findings will be crucial in shaping future regulatory frameworks. The watchdog's final report is expected to be delivered to the federal government soon, and its implications could be far-reaching.

Consumer Sentiment and Market Alternatives

Despite Woolworths' return to profit, consumer sentiment remains largely negative. Many shoppers express frustration over rising costs, with some noting that they have less money left over at the end of their shopping trips compared to previous years. This sentiment is echoed by analysts who predict that Coles may report stronger profits than Woolworths in the coming months.

Former ACCC boss Graeme Samuel has stated that he has yet to see evidence of price gouging by the supermarkets, emphasizing that competition is the key to keeping prices in check. Increased competition from brands like Aldi, Costco, and revitalized IGA stores may provide some relief to consumers seeking better prices.

The Call for Grocery Price Relief

As the federal election approaches, there is a growing call for grocery price relief. Politicians are under pressure to address the cost of living crisis, but many consumers remain skeptical about the effectiveness of proposed measures. The overarching concern is whether supermarkets will prioritize profit over the welfare of their customers.

FAQ

What caused Woolworths to return to profit?

Woolworths returned to profit primarily due to a significant reduction in losses compared to the previous year, despite facing rising costs and supply chain challenges.

How are rising food prices impacting consumers?

Consumers are feeling the pinch as food prices continue to rise, particularly for essentials like fruit and vegetables, leading to concerns about affordability.

What actions is the ACCC taking regarding supermarket pricing?

The ACCC is investigating Woolworths and Coles for potential misleading pricing practices and is expected to release a final report soon.

Are there alternatives to Woolworths and Coles for grocery shopping?

Yes, other retailers like Aldi, Costco, and IGA are increasing their presence in the market, providing consumers with more options and potentially better prices.

As Woolworths navigates its path back to profitability, the implications of its strategies will be closely watched. With consumer sentiment at a low and regulatory scrutiny intensifying, the future of grocery pricing in Australia hangs in the balance. For more on this topic and other breaking news, visit Breslin Media.